Running an E-commerce business without a robust payment processing system is nearly impossible. One of the most crucial elements of this system is a merchant account. But what exactly is a merchant account? Why is it important for your E-commerce business? How to manage a merchant account for E-commerce?

If you are wondering about all these questions, this guide is the solution for you. Here, we will walk you through everything you need to know about merchant accounts for E-commerce. From understanding the basics to finding the right provider for your business needs.

What is a Merchant Account?

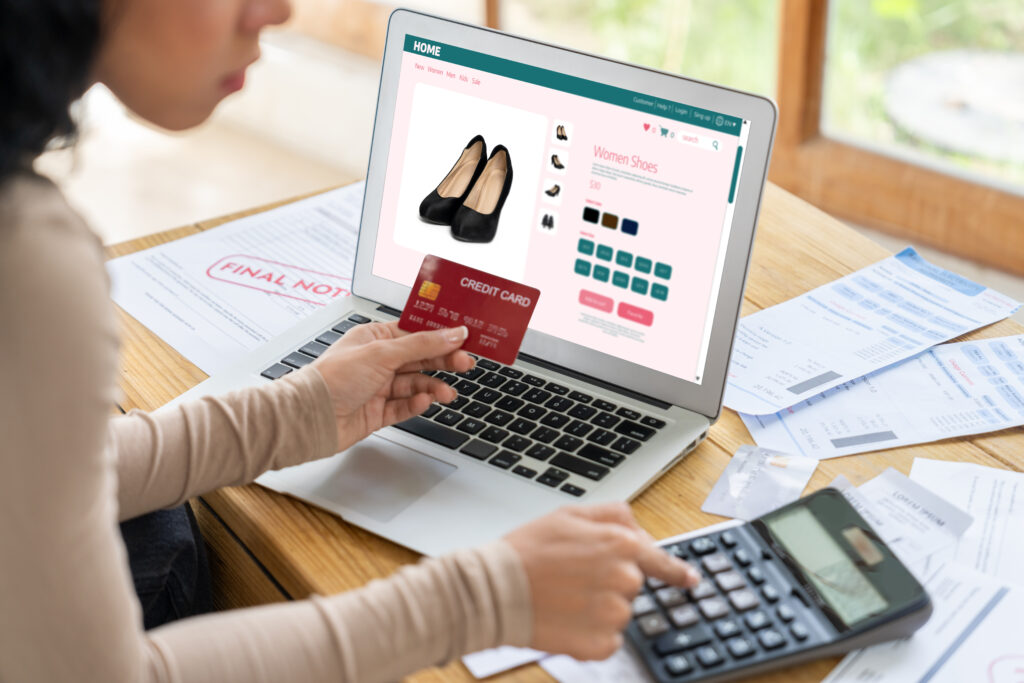

A merchant account is a type of bank account that allows your E-commerce business to accept and process credit and debit card transactions. It acts as an intermediary between your business and the bank, ensuring that customer payments are securely processed and transferred to your business account.

When a customer purchases on your online store, the funds are deposited into your merchant account. After a short holding period, the funds are transferred to your regular business bank account.

This process helps in managing chargebacks and refunds efficiently, ensuring that your business has the cash flow it needs to operate smoothly.

Why is a Merchant Account Important for E-commerce?

- Seamless Payment Processing: A merchant account for e-commerce allows businesses to accept payments from credit and debit cards, ensuring smooth and fast transactions. This is essential for e-commerce stores where instant payment verification is key to providing a good customer experience.

- Increased Sales Opportunities: By offering multiple payment methods like credit cards, digital wallets, or more, you attract a wide customer base. The more payment options you provide, the less friction there is at checkout, which can boost sales

- Enhanced Customer Trusts: Partnering with a reputable merchant account provider adds credibility to your e-commerce store. Customers feel more confident in purchasing from a site that supports secure and familiar payment methods, which can improve conversion rates.

- Better Cash Flow Management: Merchant accounts facilitate faster deposits of funds into your business bank account, helping you maintain better cash flow. This ensures you can manage daily operations, inventory, and other expenses efficiently.

- Access to Global Markets: With many merchant accounts supporting multi-currency transactions and cross-border payments, you can easily sell to international customers. This opens up global growth opportunities for your business.

- Automated Recurring Billing: For subscription-based e-commerce businesses, merchant accounts offer recurring billing features. This automates the process of charging customers on a scheduled basis, reducing the chance of missed payments and improving customer retention.

- Advanced Fraud Detection and Security: Merchant account providers typically offer strong security features like PCI compliance, encryption, and fraud detection tools, helping protect your business and customers from fraud, chargebacks, and other risks.

- Detailed Transaction Tracking and Reporting: Merchant accounts provide real-time data and detailed reporting tools that help you monitor your sales, identify trends, and manage refunds or chargebacks efficiently. These insights are crucial for optimizing your business operations.

- Chargeback Management: With built-in fraud prevention tools and clear transaction data, merchant accounts make it easier to handle chargebacks, reduce disputes, and protect your business from fraudulent claims.

- Improved Business Credibility: Having a professional merchant account, especially with well-known providers like PayPal or Stripe, boosts your e-commerce store’s reputation. Customers are more likely to trust a business that offers familiar, reliable payment gateways.

What Are the Types of Merchant Account for E-commerce?

- Dedicated Merchant Account: This is a merchant account that is specifically set up for your business. It provides you with a unique Merchant ID, allowing for greater control over your transactions. Dedicated merchant accounts usually come with lower transaction fees but may require a lengthy approval process and a monthly fee.

- Aggregate Merchant Account: It is also known as a third-party merchant account. This type is shared among multiple businesses. Services like PayPal, Stripe, and Square offer aggregate merchant accounts. They are easier to set up and usually have no monthly fees, but they might come with higher transaction fees. It is accessible for startups or small businesses.

- High-Risk Merchant Account: It is specifically designed for businesses that operate in industries considered high-risk. For instance, online gambling, adult entertainment, or travel services. It allows high-risk businesses to accept credit card payments. Furthermore, it also specializes in fraud protection and chargeback management. However, this type of account has higher transaction fees and stricter contract terms.

- Offshore Merchant Account: An offshore merchant account is set up with a bank located outside the merchant’s home country. It is often used by businesses looking to reduce tax liabilities, avoid certain regulatory restrictions, or expand their global reach. It potentially lower tax rates and regulatory advantages depending on the offshore jurisdiction. Along with this, this account may offer more flexible terms and easier approval for high-risk businesses. However, it requires higher setup and maintenance costs compared to domestic accounts.

- Mobile Merchant Accounts: A mobile merchant account allows businesses to process payments on the go using mobile devices such as smartphones or tablets. These accounts are typically paired with mobile card readers or payment apps. This account is ideal for businesses that operate in various locations, like food trucks, pop-up shops, or service providers who visit clients. It is easy to set up this account with no need for a traditional point-of-sale system.

- Internet Merchant Account: It is specifically designed for online businesses, an internet merchant account facilitates E-commerce transactions. It is integrated with a payment gateway that securely processes online credit and debit card payments. It helps to integrate fraud detection and prevention tools to protect against online scams. However, it requires integration with an E-commerce platform, which can involve additional costs and technical setup.

- Retail Merchant Account: Retail merchant accounts are designed for brick-and-mortar stores and include the necessary hardware and software to process in-person transactions, such as point-of-sale systems. This account requires lower transaction fees for in-person payments due to reduced fraud risk. Moreover, initial steps to create this account can be high due to the need for specialized equipment. It is not even suitable for businesses that do not have a physical storefront.

How to Choose the Right Merchant Account for E-commerce Business?

Consider these factors while choosing the merchant account for your E-commerce business-

- Transaction Fees: Different providers charge different transaction fees, which can vary based on the type of payment method, the country of the customer, and the volume of transactions. Compare the fees to ensure they fit within your budget.

- Security Features: Also, look for a provider that offers robust security features such as PCI compliance, encryption, and fraud protection. This will protect both your business and your customers’ sensitive information.

- Integration: The merchant account should easily integrate with your E-commerce platform. So, whether you are using Shopify, WooCommerce, Magento, or another solution, seamless integration ensures a smooth payment process for your customers.

- Customer Support: Reliable customer support is essential in case you encounter issues with transactions or need assistance with your account. Choose a provider that offers 24/7 support via multiple channels like phone, email, and live chat.

- Contract Terms: Additionally, be sure to read the fine print before signing up for a merchant account. Some providers may require long-term contracts, while others offer more flexible terms. So, consider your business needs and choose a provide with terms that align with your business goals.

Top 10 Merchant Account Providers for Your E-commerce Business

PayPal

- Location: San Jose, California, USA

- Overview: PayPal is a global leader in online payments, offering secure and easy-to-use payment processing for e-commerce. Its merchant services support credit cards, digital wallets, and multi-currency transactions, making it suitable for businesses of all sizes.

Stripe

- Location: San Francisco, California, USA

- Overview: Stripe provides a highly customizable payment processing solution through its developer-friendly platform. It supports various e-commerce business models, including subscriptions, one-time payments, and multi-currency transactions, with advanced fraud detection.

Outsourcing Buddy

- Location: Sunrise, Florida, USA

- Overview: Outsourcing Buddy is known for its low transaction fees and transparent pricing. It provides tailored merchant services for e-commerce businesses, including recurring billing, secure gateways, and mobile payment solutions. Contact their team to get more details or if you need other services as well.

Square

- Location: San Francisco, Calfornia

- Overview: Square is known for its user-friendly payment solutions that cater to small and medium-sized businesses. It offers e-commerce integration, mobile payments, and POS systems with transparent pricing and no long-term contracts.

Authorize.Net

- Location: Foster City, California, USA

- Overview: Owned by Visa, Authorize.Net is a trusted payment gateway for secure e-commerce transactions. It offers fraud prevention, recurring billing, and seamless payment processing for businesses of all sizes, particularly those seeking strong security features.

Fattmerchant

- Location: Orlando, Florida, USA

- Overview: Fattmerchant provides a subscription-based payment processing model, eliminating percentage-based fees, which makes it ideal for high-volume businesses. Its platform offers advanced analytics, secure payment gateways, and mobile payment solutions.

Dharma Merchant Services

- Location: San Francisco, California, USA

- Overview: Dharma focuses on ethical payment processing with transparent pricing, ideal for non-profits and small businesses. It offers a secure payment gateway, recurring billing, and support for mobile and e-commerce payments.

BlueSnap

- Location: Waltham, Massachusetts, USA

- Overview: BlueSnap provides a global payment gateway that simplifies e-commerce operations with multi-currency support, fraud prevention, and analytics tools. It’s designed for businesses looking to scale internationally.

Stax (formerly Fattmerchant)

- Location: Orlando, Florida, USA

- Overview: Stax offers innovative subscription-based pricing with no transaction percentage fees. It’s an excellent option for businesses that process high transaction volumes and need robust reporting and payment gateway features.

CDGcommerce

- Location: Chesapeake, Virginia, USA

- Overview: CDGcommerce provides cost-effective merchant account services with no hidden fees. It offers a reliable payment gateway, fraud protection, and great customer service, making it a strong choice for small to mid-sized e-commerce companies.

How Outsourcing Buddy Can Support E-commerce Operations Service Providers?

Running an eCommerce operations service can be a complex endeavor, requiring a combination of specialized skills, technology, and resources to manage various aspects like inventory, order processing, customer handling, and more.

Outsourcing Buddy is designed to streamline and enhance these operations, allowing businesses to focus on core growth strategies while ensuring seamless service delivery to their clients.

- Cost-Effective Resource Management: We provide scalable teams and cost-effective resource management for businesses of all sizes, ensuring that you have the right talent to handle eCommerce operations without the high overhead costs associated with full-time staff.

- Enhanced Client Support: Offering 24/7 multilingual customer service, ensures your clients’ customers receive consistent, high-quality support, improving customer satisfaction and retention across global markets.

- Streamlined Order Processing and Fulfillment: Our team efficiently handles order processing and inventory management, helping businesses manage high volumes of orders accurately and on time, reducing the risk of errors and delays.

- Expertise in Digital Marketing: With advanced outsourcing SEO services, email marketing for small businesses and other industries, and PPC services near you, they boost your client’s online visibility and drive sales, ensuring that their eCommerce platforms attract and convert more customers.

- Advanced Data Analytics and Reporting: We provide data-driven insights and customized reporting, enabling businesses to make informed decisions and demonstrate the value of their eCommerce operations to clients.

- Technology and IT Support: Furthermore, we offer comprehensive IT services and eCommerce platform integration support, ensuring that your clients’ technology infrastructure is robust, secure, and optimized for seamless online transactions.

- Flexibility and Focus on Core Business: By taking over routine eCommerce tasks, we allow businesses to focus on their core services and innovation, offering flexible outsourcing solutions that adapt to businesses of all sizes and needs. We also offer other services including digital marketing, image optimization, video production, and more.

Conclusion

A merchant account is a critical component of your E-commerce business’s payment processing system. It not only ensures secure and efficient transactions but also enhances your business’s credibility and customer trust.

Choosing the right merchant account type for your business depends on your specific needs, business model, and industry. A suitable merchant account for E-commerce is crucial but finding it through the right procedure is more important.

Whether you’re operating a physical store, an online business, or both, understanding the different types of merchant accounts can help you select the one that aligns with your goals and ensures smooth, secure payment processing.

Outsourcing Buddy ensures that your clients’ eCommerce platforms operate smoothly and effectively. We also handle the complexities of eCommerce operations, driving success in a competitive market. So, schedule a free consultation today for your business.

Frequently Asked Questions by Users

Question: What is a merchant account for E-commerce, and why do I need one?

Answer: A merchant account for E-commerce is a specialized bank account that allows businesses to accept online payments, including credit and debit card transactions. It’s essential for any eCommerce business as it enables you to process payments securely, ensuring that your customers can pay conveniently and that funds are transferred to your business account efficiently.

Question: What are the fees associated with a merchant account for E-commerce?

Answer: Fees for a merchant account can vary depending on the provider and the type of account. Common fees include transaction fees (a percentage of each sale), monthly fees, setup fees, and chargeback fees. It’s important to review and compare these fees to find the best fit for your business needs and budget.

Question: How do I choose the right merchant account provider for my eCommerce business?

Answer: When choosing a merchant account provider, consider factors such as transaction fees, the range of payment methods supported, integration with your eCommerce platform, security features, client support, and any additional services like fraud prevention or analytics. Selecting a provider that aligns with your business size, sales volume, and growth plans is crucial.

Question: Are there specific merchant accounts for high-risk E-commerce businesses?

Answer: Yes, high-risk eCommerce businesses, such as those in industries with a higher likelihood of chargebacks or fraud, may need to apply for a high-risk merchant account. These accounts come with higher fees and stricter terms but are designed to accommodate the unique challenges of high-risk industries.

Question: Can I accept international payments with an E-commerce merchant account?

Answer: Many eCommerce merchant accounts support international payments, allowing you to accept payments in multiple currencies and from customers around the world. When selecting a provider, ensure they offer global payment processing and consider the associated fees for cross-border transactions.

Noodlemagazine very informative articles or reviews at this time.

Thank you for your feedback. Keep reading.