Outsourcing has become an integral part of modern strategies for small, medium, and large businesses. Therefore, companies increasingly prefer to delegate non-core functions to specialized service providers. One such area that has witnessed a significant surge in outsourcing is accounting. However, outsourced accounting services offer a range of benefits, but they also come with their fair share of challenges.

Today, in this guide, we will explore the pros and cons of accounting services for outsourcing and provide a list of top outsourcing companies in the USA.

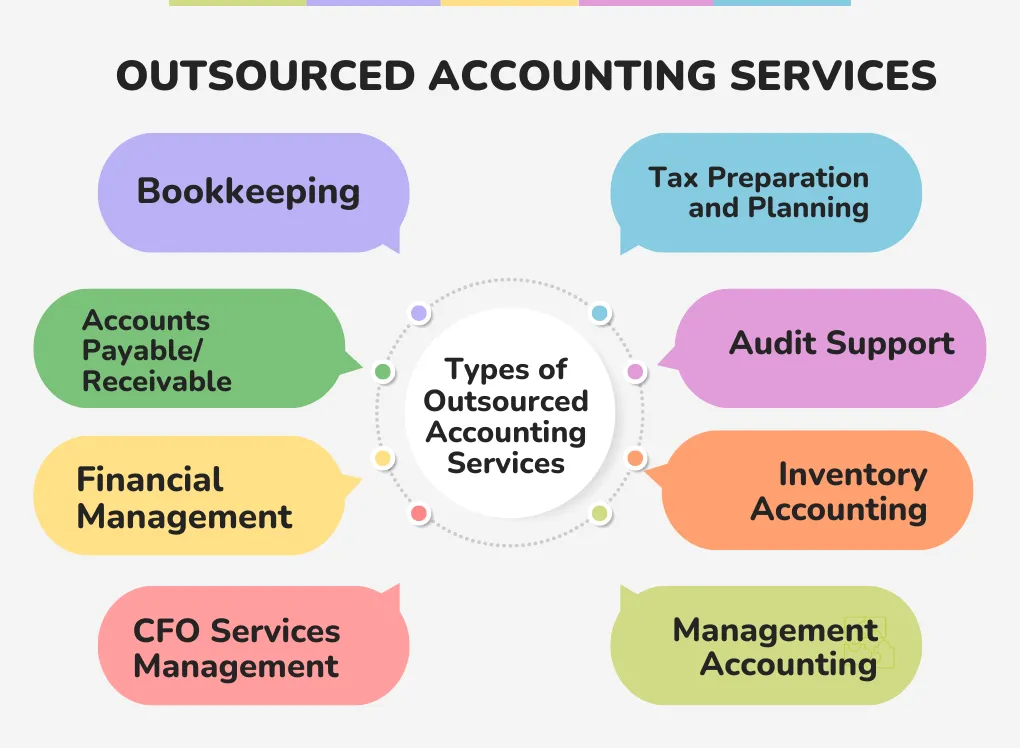

How Many Types of Accounting Services Can be Assigned to Others?

Here are some standard services that you can assign to an external team-

- Bookkeeping: First and foremost, outsourced accounting services include bookkeeping. It is the foundational element of accounting, involving the recording and organizing of financial transactions. Outsourced companies can maintain ledgers, reconcile bank statements, and manage accounts payable and receivable.

- Accounts Payable/Receivable Management: It involves handling invoices, payments, and collections. So, outsourcing these tasks ensures that payment processes are efficient, and cash flow is effectively managed.

- Financial Management: Analyzing financial data to identify trends, opportunities, and risks is crucial for decision-making. So, if you outsource these services, you get valuable insights into your business’s financial performance.

- CFO Services Management: Medium-sized and small businesses may outsource Chief Financial Officer (CFO) services on a part-time or project basis. So, if you outsource virtual CFOs, it offers you financial advice, budgeting, and financial planning services.

- Tax Preparation and Planning: Outsourcing tax-related tasks is another service that includes preparation and planning. External providers can navigate tax codes, identify deductions, and guarantee adherence to evolving tax laws.

- Audit Support: Businesses that use external audit assistance services can better navigate and be ready for financial audits. Because of this, outsourcing this task guarantees that financial records are orderly and adhere to auditing requirements.

- Inventory Accounting: Outsourcing inventory accounting services may help companies that deal with inventory. So, they can easily maintain and track inventory levels, do appraisals, and optimize stock levels to save holding costs.

- Management Accounting: It focuses on providing internal stakeholders with the required information for decision-making. Outsourced management accounting services can include budgeting, cost analysis, and performance reporting.

The range of accounting services that you can outsource is extensive and diverse. Therefore, you can customize your outsourcing strategy based on your specific business needs.

What Are the Pros of Outsourced Accounting Services?

- Cost savings: One of the primary reasons for outsourcing accounting services for small businesses is cost efficiency. Outsourced companies frequently operate in areas with cheaper labor expenses. As a result, it gives companies access to highly qualified accountants for a far lower price than they would pay to hire an in-house team.

- Emphasis on Core strengths: In addition, businesses can focus on their strategic goals and core strengths by outsourcing accounting tasks. Moreover, it helps them to refocus resources and attention on tasks that directly support their growth and success. Most small businesses prefer to assign mundane financial tasks to external professionals.

- Access to Expertise: Furthermore, companies typically hire external specialists with diverse skills and experience in finance and accounting. This ensures companies benefit from the experience of experts who stay abreast of industry rules and best practices.

- Scalability: An organization’s accounting requirements change as it expands. Scalability is a feature of outsourced tasks that lets businesses modify the level of support based on their current needs. Simply put, this flexibility is especially beneficial for small and medium-sized businesses and startups.

- Advanced Infrastructure and Technology: Reputable outsourcing companies invest in infrastructure and technology to improve the quality of their services. As a result, companies can leverage these resources without having to pay the hefty prices to acquire such technologies in-house.

Cons for Partnering with an External Team for Accounting Services

- Security Concerns: Firstly, entrusting sensitive financial information to an external party raises security concerns. While reputable outsourcing firms implement robust security measures, there is always a risk of data breaches that could compromise the confidentiality and integrity of financial data.

- Communication Challenges: Working with an external service provider may result in communication challenges, especially when there is a significant time zone difference. Simply put, miscommunication or delays in response time can impact the efficiency of financial operations.

- Dependency on Third-Party: Additionally, relying on an external entity for critical financial functions means relinquishing a degree of control. Businesses may face challenges if the outsourcing partner encounters internal issues or fails to meet service-level agreements.

- Quality Control: Moreover, maintaining consistent quality in accounting services can be challenging when operations are distributed across different locations. Businesses need to establish robust monitoring mechanisms to ensure that outsourced work meets the desired standards.

- Risk of Regulatory Non-Compliance: Apart from these, different regions have varying accounting and tax regulations. Businesses outsourcing accounting services must ensure that their external partners are well-versed in the applicable regulations to avoid compliance issues that could result in legal repercussions.

Top 7 Accounting Outsourcing Companies in the USA

- Remote Coworker: Remote coworker is a leader in professional services, offering a wide range of accounting, auditing, and advisory services. With a strong presence in the USA, it provides comprehensive solutions to businesses of all sizes.

- Indinero: Indinero is another player in the accounting and professional services industry. Moreover, the firm is known for its commitment to quality and innovation. It offers tailored solutions to meet the unique needs of its clients.

- Meru Accounting: Meru Accounting is a multinational professional services network with a significant presence in the USA. Moreover, the firm provides a range of accounting and consulting services, leveraging its global network of professionals.

- Outsourcing Buddy: The other best partner is Outsourcing Buddy to outsource your accounting services. Here, you get the best of services as per your business requirements irrespective of large, small business, or middle-sized business. Moreover, they even provide customized services so that you get what you desire. So, for more details, contact the team and get the information you need for a better experience. They even have different services that you can outsource, like back office outsourcing services, digital marketing, E-commerce customer service, and more.

- Whiz Consulting Pvt Ltd: Whiz Consulting Pvt Ltd is experienced in assurance, tax, transaction, and advisory services. In addition to this, with a focus on innovation and digital transformation, it helps businesses navigate the complexities of the modern financial landscape.

- BDO USA: BDO USA is a member of the BDO global network, offering assurance, tax, and advisory services. Additionally, it is known for its personalized approach, BDO serves clients across various industries, including healthcare, technology, and manufacturing.

- RSM US LLP: RSM US LLP is a leading provider of audit, tax, and consulting services. With a strong commitment to client success, it serves a diverse range of industries. Furthermore, helping businesses navigate financial challenges and opportunities.

Tips to Find a Best Outsourced Accounting Service Company

It is crucial to find the right partner if you are planning to assign some of your accounting services to an external team. Therefore, while you are evaluating potential outsourcing partners, you must consider some essential questions. Here, is the list that you can take into consideration that matches your business needs-

- Does that outsourcing company have any case studies or success stories from businesses that are comparable to yours?

- Do they have positive client testimonials and references based on the accounting services they offer?

- What kinds of training or qualifications does their team of accounting professionals possess?

- How do they stay compliant with pertinent tax laws and guidelines?

- How well they will work with your internal accounting team to integrate?

- Do they support the accounting software applications you use in your company?

- Do they stay updated on the latest tools and technology available for accounting services?

- What data security procedures do they use to safeguard sensitive customer data?

- How much time will their team of accounting experts require for onboarding?

- What kind of communication will you have with the accounting outsourcing company?

Conclusion

To sum up, outsourced accounting services have become a strategic choice for businesses looking to streamline their financial tasks. All businesses, nevertheless, weigh the pros and cons before deciding to work with an external team.

Furthermore, we advise you to conduct thorough research before choosing an outsourcing partner, considering reputation, experience, etc. Then, select the finest option that satisfies the regulatory requirements of your business. Choosing the ideal outsourcing provider and finding the right balance will enable your company to reach its maximum potential to drive efficiency and expansion. So, choose wisely.

But, if you are searching for a trusted partner in Florida, USA, Outsourcing Buddy would be the better choice. So, schedule a quick meeting with the team and scale your accounting services in a better way to grow your business.

So, get better data, and make better decisions today!

Frequently Asked Questions

Question: What is an outsourced accounting company?

Answer: It refers to a qualified specialist or accounting services provider to whom you can delegate your accounting work. Experts in accounts payable or accounts receivable, bookkeepers, accountants, and more may be included.

Question: Is outsourcing accounting tasks affordable?

Answer: Generally speaking, cloud-based accounting and bookkeeping will save you money. Additionally, it will provide you with more time to grow your company. If you understand the true costs of keeping your in-house internal finances, it could be time to switch to an outsourced provider. In case, if it becomes more challenging for you to run the business, you may scale back and stop worrying about having as many staff members or space.

Question: What is the cost of accounting outsourcing?

Answer: It’s reasonable to assume your monthly expenses for outsourced bookkeeping costs. However, the costs for your business will vary within the range based on the bookkeeping support you choose. Moreover, prices depend on factors such as: Whether software, humans, or both are used in the service.

It’s really a cool and helpful piece of information. I am satisfied that you just shared this helpful info with us.

Please keep us up to date like this. Thank you for sharing.

You have noted very interesting points! ps nice site.Blog money

Thank you so much for your feedback, means a lot.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for taking the time to read and comment. Yes, there are more related content, visit our site for more such content.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for kind words. It’s fantastic to hear that you found the article valuable. Feel free to reach out for any further questions.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I truly appreciate your kind words. It is always my goal to deliver content that resonates with the audience.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I am glad that you found the blog interesting. Please feel free to ask any question.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you so much for your encouraging words! Please, keep reading.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for the compliment! I’m glad the content piqued your interest. Please share your question, I’d be happy to discuss it further.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your feedback.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you so much for sharing your thoughts. Keep reading!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your feedback. I’m glad you liked the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

thank you for your kind words. Keep reading.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for reaching out! Feel free to ask your question, we’d love to answer your questions.

Your article helped me a lot, is there any more related content? Thanks!

I’m glad you liked the content, for more related content please visit our website. Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I’m glad the viewpoint caught your eyes. Feel free to ask your question, I’d do my best to help you out. Thanks!

Your article helped me a lot, is there any more related content? Thanks!

I am glad you liked the content. This means a lot. Fore more related content, visit or website please. Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I’m happy to know that you liked the posts. Thank you!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

We’re glad you got creative ideas from our blogs. Please, feel free to ask your question, our team will help you out. Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you so much for your kind words.

Your article helped me a lot, is there any more related content? Thanks!

Glad to hear that. For more related content, visit our website. Thanks!